Individual Long-Term Care Insurance Premium Deductibility

Premiums for long-term care insurance are deductible with other individual medical expenses under IRC Section 213(d)(1)(D).

For the premiums to be deductible, long-term care (LTC) insurance must be considered “tax-qualified” under IRC Section 7702B(b)). Fortunately, most LTC insurance issued today are tax-qualified. A non-tax-qualified LTC insurance policy typically means they don’t have a minimum Activities of Daily Living (ADL) restriction or they are more lenient in the certification requirements to be eligible for claims.

Premiums paid for tax-qualified LTC insurance are deductible if paid for the individual taxpayer themselves, their spouse, or any dependent as defined under IRC Section 152, which can include both dependent children and even dependent parents, if they otherwise qualify as dependents for tax purposes, and without regard to the must-be-unmarried or income tests that otherwise apply to a “qualifying relative” dependent.

Long-term care insurance premiums are deductible, but the amount of the deduction is limited.

When determining if LTC insurance premiums are deductible for an individual, the standard rule for medical expenses applies. To claim a deduction, you must itemize deductions on Schedule A and only the portion in excess of 7.5% of Adjusted Gross Income (AGI) is deductible. When calculating the total pool of medical expenses, you would add the LTC insurance premiums and all other medical expenses.

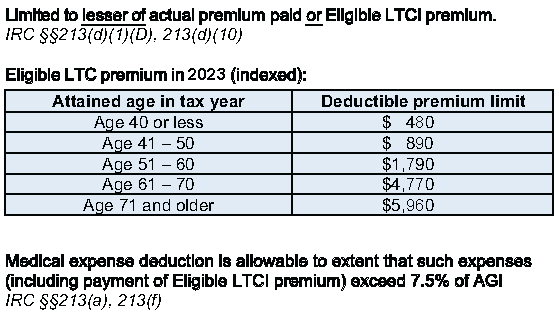

In addition to the limitation on total medical expense deductions (including LTC insurance premiums), there is a limitation on the amount of LTC insurance premiums that can be counted as a medical expense. Premiums can only be deducted up to a specific annual dollar amount under IRC Section 213(d)(10). The LTC insurance premium deductibility limits for 2023 are shown below, with age thresholds based on the taxpayer’s age at the end of the tax year.

Example: In 2023, Steven and Barb turn 65 and 60. They bought a tax-qualified LTC insurance policy. Steven’s policy is $3,600/yr and Barb’s is $3,400/yr.

- Steven can deduct $3,600 (his entire premium since it’s below the $4,770 threshold).

- Barb can deduct $1,790 (a portion of her premium since the age based threshold is $1,790).

- Combined, Steven and Barb can claim $3,600 + $1,790 = $5,390 of their LTC insurance premiums as deductible medical expenses. They would add $5,390 + other medical expenses to get their total medical expenses. Whatever their total medical expenses amount is, it must exceed 7.5% of their AGI, and then the excess above the 7.5% threshold will be deductible.

- When Barb turns 61 next year, her deductibility limit will increase to $4,770 and she can deduct her entire premium since it’s below the $4,770 threshold. Then their total LTC insurance premium deductions will be $3,600 + $3,400 = $7,000. This number is then added to their other medical expenses to determine how much is deductible above the 7.5% of AGI threshold.

- When Steven and Barb are in their 70s, the max they can deduct is limited to the amount of LTC insurance premiums paid each year ($3600 and $3,400).

As you get older, there’s potential to deduct a higher amount of your LTC insurance premiums.

States Credits & Deductions

Some states will also give taxpayers a tax deduction or credit for buying LTC insurance. The deduction or credit may only be for the first year premium or it could be allowed as long as premiums are paid. Some states have no limits on the amount of LTC insurance premiums eligible for the deduction or credit. Some follow the age-based premium limitations. Consult a tax professional for current state tax deductions and credit rules.

Traditional (Stand-Alone) vs. Hybrid LTC Insurance Deductibility

Depending on how your policy is structured will also dictate how much you can deduct.

If you have a tax-qualified traditional (stand-alone) LTC insurance policy, you are allowed to consider the entire premium amount for deductibility (still restricted to age-based thresholds if an individual).

If you have a hybrid/linked-benefit LTC policy where LTC insurance is combined with life insurance, only the premium that is paid for the LTC coverage is able to be considered for deductions, not the premiums for life insurance coverage. Note: Not all hybrid/linked-benefit policies separate the charges so that the LTC premium is separate from the life insurance premium. If they are not separate charges, you won’t be able to deduct any of the premium.

Example: Steven and Barb have a joint hybrid policy that separates the LTC and life insurance charges.

- The annual LTC premium is $4,781 and life premium is $3,219 for a total annual premium of $8,000.

- They can only consider the LTC premium of $4,781 when calculating deductibility, not the life insurance premium.

LTC Insurance Paid & Deducted By Businesses

Buying LTC insurance through a business can provide significant tax benefits as the rules are different when paying premiums through a business, as opposed to an individual.

Click here to learn more about LTC insurance tax deductions for businesses.

Are LTC Insurance Benefits Received Tax-Free?

All benefits received from a reimbursement LTC insurance policy are tax-free. However, benefits from a cash or indemnity (per diem) policy are limited to a daily (per diem) limit. For claims in 2023, benefits from an indemnity policy are received tax-free up to $420 per day ($12,775/month) OR your actual expenses paid for care, if greater.

Example: You have a cash indemnity policy that pays $250/day or $7,500/month.

- Benefits are tax-free, even if what you spent on care was less since $250/day, since $250/day is less than the per diem limit of $420/day.

- If you receive a per diem benefit of $470/day, then $50/day would be considered taxable income.

- If you receive a per diem benefit of $450/day, but you have $450 or more per day in care expenses, then it’s all tax-free.

The Bottom Line

If you own a long-term care insurance policy, there are potential tax deductions available for individuals and business owners. Consult with your tax professional to review the details.

*Tax information presented here is for general information only and should not be used nor relied upon as specific tax advice. Taxpayers should consult with their CPA or tax advisor for advice regarding their own tax situation and the tax status of LTC premiums and benefits.