The Pension Protection Act & Long-Term Care

Aren’t we all tax rebellious to a certain extent and within reason? Enter the Pension Protection Act (PPA), which just might be the best tax incentive afforded to people concerned about paying for long-term care (LTC). It is legislation that was passed by Congress in 2006 and became effective January 1st, 2010.

Why do we love the PPA and how is it tax advantaged for all considering LTC Planning? It allows people do to a 1035 exchange or simply transfer an existing Non-Qualified annuity or life insurance policy, with taxable gains, into a new policy that provides tax-free LTC benefits. It encourages people to plan for future care and take advantage of the tax incentives inherent to LTC insurance.

What type of insurance contracts can be used with a 1035 exchange?

1. Annuity (fixed or indexed) with LTC benefits

These can provide LTC protection, cash value (also known as Accumulated Value), or both. Any amount of the cash value not used for LTC will be passed to your beneficiaries as a Death Benefit.

These policies have two buckets of money:

1) A base policy which is the death benefit/cash value and

2) An extension/continuation of LTC benefits

If you need LTC, the base policy’s death benefit/cash value is used first to pay for care. After the base policy is fully used, the second bucket of money is used to pay for care for a specified duration, up to a monthly maximum for LTC. These policies typically provide a LTC benefit pool 2-3 times the base policy amount, but lifetime unlimited benefits are also available. Therefore, leveraging a current annuity value and using tax laws to provide tax-free LTC benefits.

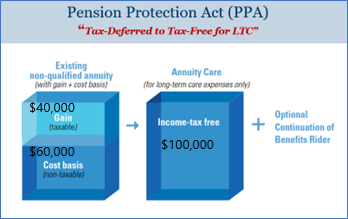

Before the PPA, annuity owners had to spend taxable gains before the principal (referred to as Cost Basis), could be used for tax-free purposes. Cost Basis is considered the after-tax purchase price in a Non-Qualified annuity contract. Non-Qualified annuities that meet PPA provisions allow you to withdraw money for LTC coverage income tax-free.

When filing an LTC claim in this case, the Cost Basis will be distributed first prior to the gain within the contract. This will not be the case for Non-Qualified Annuities that do not meet the PPA provisions.

Example: Using Non-Qualified Annuity for Tax Free LTC expenses

If you have a $100,000 non-qualified annuity with a $60,000 cost basis (not taxable) and $40,000 in deferred gains (taxable unless used for LTC expenses). You could complete a 1035 exchange so the $40,000 gains transfer tax-free to the new LTC policy. Not only are you able to transfer those gains tax-free, but those gains can be withdrawn later tax-free for LTC expenses, whether you’re receiving care at home or in a facility. LTC hybrid annuities will also provide leverage on your deposit, so that if you put in $100k, you can get additional coverage beyond your deposit of $200k or $300k for LTC.

If you do not use the policy for LTC, your named beneficiaries will inherit the taxable gains as they would have in the first place.

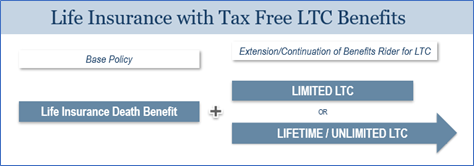

2. Life insurance with LTC benefits

These can provide LTC protection, a death benefit, or both. Any amount of the death benefit not used for LTC will be passed to your beneficiaries. These policies have two buckets of money:

1) A base policy which is the death benefit and

2) An extension/continuation of LTC benefits

If you need LTC, the base policy’s death benefit is used first to pay for care. After the death benefit is fully used, the second bucket of money is used to pay for care for a specified time. Under the PPA, a qualifying life and LTC policy allows you to use the death benefit as needed to pay for qualifying LTC expenses. Premiums are guaranteed and often benefits can increase over time. These policies typically provide a LTC benefit pool 2-3 times the base premium amount, but lifetime unlimited benefits are also available.

Both life insurance and annuity hybrid solutions offer comprehensive coverage like traditional LTC insurance policies by paying for home care, assisted living or skilled nursing facility care up to a contractually stated monthly LTC maximum. Plan design and policy limits vary by insurance carrier.

7702B and non-qualified

The new LTC policy must be considered tax-qualified under IRC Section 7702B (which most are) and the existing annuity must be considered Non-Qualified which means it was funded with after-tax dollars. You can’t fund a policy with pre-tax dollars like from an IRA or 401(k) because it’s considered qualified money. To receive the preferential tax treatment, the funds must be directly sent from the existing life insurance or annuity policy to the new LTC insurance company. The new LTC insurance company must be able to accept the funds via a 1035 exchange and not all companies can.

Can the policy owner be changed when doing a 1035 exchange?

The new policy owner must be the same as the existing owner. It’s considered “like-to-like.” If spouse A owns an annuity or life insurance policy and they want coverage for both spouses, Spouse A could be the owner on the new policy and both A and B spouses would be joint insureds, enabling both to get LTC protection. There’s also an option of adding a spouse without changing ownership for the purpose of LTC benefits, but it’s rare. It’s called the “Eligible Person” provision. It allows a tax-deferred contract with a single annuitant/owner to provide LTC coverage for both spouses. Requirements are that the Eligible Person must be a spouse, must be named at the time of the application, must be named as the primary beneficiary, and the Eligible Person and annuitant both must receive underwriting approval.

Are partial exchanges allowed?

Partial exchanges may be allowed with the gain, but the procedures may vary depending on the insurance company.

Underwriting

Medical underwriting is more lenient with hybrid annuities than life hybrids and traditional LTCi, but there are still health qualifications that must be met with these products.

How will LTC benefits be reported?

LTC benefits and premiums paid for qualified LTC insurance from annuity values will be reported on Form 1099-LTC, but you don’t have to pay tax on them.

The Right Fit

Who may want to consider an annuity or life policy with LTC benefits? If you have an existing life insurance policy that has significant cash value and you don’t need the death benefit or if you have a Non-Qualified annuity that has significant gains and you don’t need it for income, you can use that to fund a policy for LTC protection. You can do a 1035 exchange and receive tax-free benefits for LTC with both solutions. The hybrid annuity policies are often a good fit when your health is not great and you won’t qualify for a traditional LTC insurance policy. There are companies offering hybrid annuity solutions, as described above, up to age 85. It would be wise to consider a LTC hybrid annuity where you can take tax-free withdrawals for LTC instead of taking taxable withdrawals from a Non-Qualified annuity to pay for LTC expenses.

The Bottom Line

The PPA encourages the purchase of LTC insurance within the private sector. The government would prefer people and insurance companies pay LTC costs rather than people spend down their assets and then apply for Medicaid assistance. This can be a great strategy for those who have an existing annuity set aside to pay for LTC expenses and for those who were planning to self-fund their care costs.

It’s a good idea to work with an independent LTCi Specialist like Kelly when putting an LTC plan in place.